Frequently Asked Questions

What is the Valor Fund?

The Valor Fund is a company that provides insights to our paid subscribers on when to buy and sell stocks in their investment account, by utilizing our proprietary strategy. The goal of the company is to help paid subscribers make returns that are better than the broader market, and aid in portfolio allocation and cash management.

How do I participate?

You can participate by simply following our insights in your investment account, so that the same returns we expect and experience, you do as well. Simply put, when we buy, you buy, and when we sell, you sell.

We go a step further and provide data on how much we invested based as a percentage of our entire portfolio. This allows us to translate the returns and risk management we have in our portfolio across any account and account size.

For example, if we invested 1% of our account size in AAPL and if your account size is $100,000; then you would invest 1% of $100,000 in AAPL.

Subscribe here to get our insights now!

What are the different subscriptions?

Scan A Stock

Scan A Stock is a one-time, no subscription, pay-as-you-go report where we analyze any stock of your choice using our proprietary strategy.

How it works:

-

You choose 1 ticker to scan

-

We perform a full analysis of your ticker on the weekly time scale

-

We send an email to you with the following reports as .csv files:

-

Combined Signal report

-

Strong Buy report

-

Buy report

-

P&L report

-

Weekly report (if any signals exist)

-

⚠️ Note: Our strategy updates once per week. Purchasing multiple scans for the same ticker within the same week won’t provide new insights. For best value, wait until the next week before scanning the same ticker again.

Signal Bundle

Signal Bundle is a monthly subscription which gives the same data as Scan A Stock but for 5 tickers instead of 1 ticker. We'll provide monthly updates for the 5 tickers of your choice.

Signal Tracker

Signal Tracker is a monthly subscription plan which gives the same data as the Signal Bundle plan, but we'll provide weekly updates on your 5 tickers.

Valor Core

Valor Core is a monthly subscription plan which provides weekly updates on all our hand-selected tickers using our proprietary scanner framework. Includes:

-

Fresh buy/strong buy signals, entries, stops & portfolio allocation

-

Transparent performance tracking of our portfolio

-

No research needed — just execution

-

Exclusive access to our private Discord channel where you can learn, engage, and grow with our community

Valor Elite

Valor Elite is monthly subscription plan that includes everything in Valor Core & Signal Tracker combined.

I've subscribed, now what?

You should get a confirmation email of your order at the email you provided during your purchase. Please watch your Inbox or Spam folder.

If you didn't get a confirmation email, please email us at hello@thevalorfund.world

Can I cancel my subscription?

Yes, you can cancel your subscription at anytime and we will honor the end date of your monthly subscription. There are no refunds for any purchase.

I'm a novice, where do I begin?

The quickest way to start is by opening a brokerage account. We like Wealthsimple & Questrade, they are simple to set up, have zero commissions and easy to use.

We hope to make posts or videos on how to set up an account and invest in Wealthsimple & Questrade soon. But if you feel adventurous, go ahead and sign up for a Wealthsimple account here and earn $25 for free!

How do I read your reports?

All the files have the same structure. The Combined Signal report is the biggest report, if you can understand this report, all the other reports are just filters of this main report.

The reports are as follows:

-

Combined Signal report

-

Strong Buy report

-

Buy report

-

P&L report

-

Weekly report (if any signals exist)

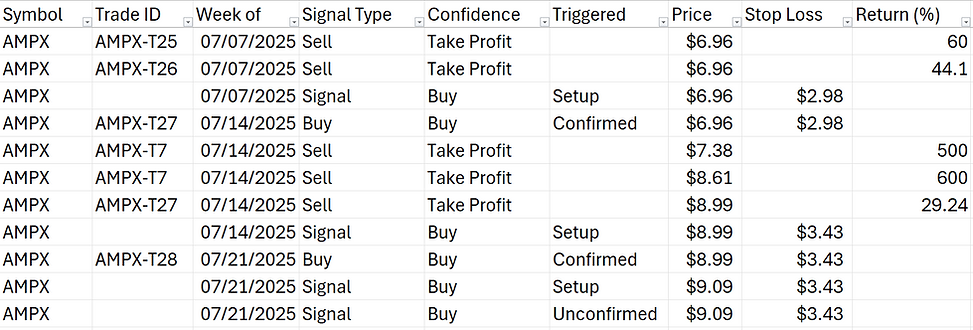

The Combined Signal Report looks like the picture below.

The report has the following key markers:

-

Signal Phase

-

Every trade begins with a Signal, which is your early heads-up. This is when you can set a stop buy (entry price). No trade has occurred yet — you’re just preparing

-

-

Buy Confirmation

-

Once the price crosses the stop buy level, the trade becomes Confirmed as a Buy.

-

Buy: Standard entry with a take profit at +20%

-

Strong Buy: Aggressive entry with three staged take profits:

-

Sell 50% at +30%

-

Sell 25% at +60%

-

Let the remaining 25% run

-

-

-

Stop Loss

-

Each trade includes a stop loss level. If this is hit, the trade is considered closed at a loss.

-

-

Return (%)

-

Shows the maximum potential return achieved after confirmation of a Buy or Strong Buy.

-

-

Trade ID

-

Each Buy and corresponding Sell or Stop Loss are linked using the same Trade ID. This helps track how the trade performed from entry to exit.

-

As an example, looking at the 3rd line from the top in the picture, we had a Signal on the week 07-Jul-2025 at $6.96 with a stop loss of $2.98. You would have placed a stop-buy at $6.96.

In the week of 14-Jul-2025, it crossed the entry price and buy is confirmed, with a Trade ID of AMPX-T27. In that same week, you hit the +20% target, and the max return possible was 29.24%.

⚠️ Note: You can choose to follow only Buy, only Strong Buy, or both — the strategy is flexible depending on your risk profile.

The Strong Buy & Buy Reports are just filtered version of the Combined Signal Report. They were created in order to quickly see the results for the Strong Buys and Buys.

The Weekly Report shows the latest signal, if any, in the current week.

The P&L Report is a basic stats report on the profit/loss and win ratio of the Strong Buy and Buy signals for each ticker. Below is a picture of typical P&L Report.

In this example, for ticker $AMPX, we have 27 trades of which, 2 were Strong Buys and 25 were Buys. Out of the 2 Strong Buys, both were successful with a maximum return of 630%. And, out of the Buys, 80% were successful with a max return of 503.86%